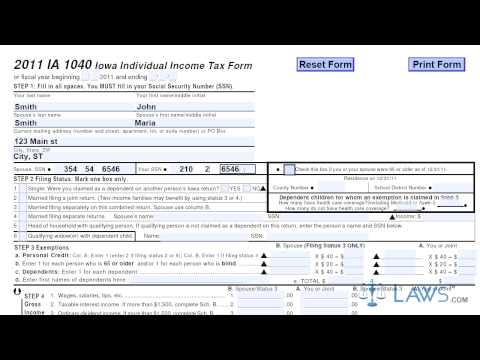

Laws.com is a website that provides legal forms and guides. One of the forms available on their website is the Iowa individual income tax form, IA 1040. This form can be filed by individuals who owe income tax to the state of Iowa, regardless of their residency status. The form can be obtained from the government of the state of Iowa's website. To complete the IA 1040 form, follow these steps: 1. Provide your name, address, and social security number. If you are filing jointly with your spouse, include their name and social security number as well. 2. Mark your filing status in Step 2. 3. Note all exemptions being claimed and include the first names of all dependents being claimed. 4. Detail and calculate your gross income in Step 4. Follow the instructions provided on the form. Remember that there are two columns provided: Column B is for your spouse if filing jointly, and Column A is for you whether filing jointly or singly. If you have over $1,500 in taxable interest or gross dividend income, complete Schedule B to fill in lines 2 and 3. 5. Calculate adjustments to your income as directed in Step 5. 6. Calculate federal tax additions and deductions as instructed in Step 6. 7. Calculate and document your taxable income in Step 7, following the provided instructions. If you are claiming an itemized deduction instead of the standard deduction, complete Schedule A to fill in line 37. 8. Document any tax credits and note any voluntary contributions being made in Step 8. 9. Document all other credits being claimed in Step 9. 10. Follow the final calculations as instructed in Step 10 to determine your balance due or refund owed. 11. If you wish to make a political checkoff contribution, note this in Step 11. 12. Sign and date the form in Section 12. For more information...

Award-winning PDF software

2018 il-1040 instructions Form: What You Should Know

A copy can be sent by check, or by mail or fax. IL-1040A: Form 1040A; Form 1040EZ; Form 1040XW; and Forms 1040-A, 1040-B, 1040-C, 1040-D For more information on IL-1040S, click here. For more information on IL-1040XW, click here. For more information on IL-1040-B & 1040-C, click here. For more information on IL-1040-D, click here. IL 1040 & 1045 Return Information — New Castle County Clerk of Courts Information on Form 1040 & 1045 to be filed with the New Castle County Clerk of Courts. Also, if you are required to file a Form 1040-C, click here for more information. IL Form 1040 & Form 1045: Where can I download the forms? Information on the online filing system for the Illinois State Treasurer, Form 1044 — Illinois Income Tax Return. Form 590B: Personal Income Tax Return The Illinois Department of Financial and Professional Regulation has released a new tax form for the 2025 tax year. Form 590B and the Instructions for Form 570, Illinois Personal Income Tax Return. Click here for more information. Creditor Fraud Alert — Illinois Attorney General Illinois Attorney General, Eric T. Median, has announced that, “as many as 2,000 fraudulent and otherwise unlawful Illinois credit card charges were made to consumers' debit accounts in 2016. Illinois Attorney General Median calls on you, as consumers and law-abiding taxpayers, to be vigilant and report any suspicious activity. You can call the Consumer Protection Hotline at or and report fraudulent or unlawful credit card activity.” Form 1040XW Tax Filing Guide Instructions — Illinois Attorney General A handy guide to completing the Illinois Form 1040XW tax form. An explanation of the due dates, the filing fees, the filing and payment deadlines, and instructions. Also, where to get it or order it. 2018 Individual Income Tax Forms for Illinois — Illinois State Treasurer Information on tax season 2025 for Illinois personal income tax return filers. Includes information on how to pay your taxes and the new state income tax brackets.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040 - Schedule M, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040 - Schedule M online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040 - Schedule M by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040 - Schedule M from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 form il-1040 instructions