Music will now be recorded. Hello everyone and welcome to completing a simple tax return with unlimited taxes and more. What you see in front of you is our demonstration software, so let's just get a lay of the land before we move into things. It helps to understand where we are and what we're doing and how to get around before we dive into a tax return. What you have in front of you is the work-in-progress summary. If you notice at the top, we have these three tabs called navigation tabs. Right now, we're on the 1040 returns tab, but we can switch to do business returns if we have a corporate entity in front of us and we need to do that. Just click on the business returns tab and we're back to the 1040. Underneath the navigation tabs, we have the menu. You can click on these just like any piece of Windows software to bring down a little menu. Underneath the menu, we have the toolbar. Think of the toolbar as access to those things that you use all the time, like adding a new return or transmitting to the IRS. Just click on these things and it'll take us directly to that spot without having to navigate countless buttons. If ever you're off that work-in-progress summary and main page and you want to go back to it, in the toolbar we have the WIP button that'll bring you straight to that work-in-progress summary. Under the toolbar, we have what's called the information bar. The most important thing about this information bar is the version of the software right in the middle. You can tell we're currently using 2018 dot 34. If we're having some sort of issue, we want to make sure that we're at the latest...

Award-winning PDF software

2018 il 1040 instructions Form: What You Should Know

Gov 2017 Individual Income Tax Forms — Illinois.gov 2017 Individual Income Tax Forms ; Instructions · Instructions ; Automatic Extension Payment for Individuals Filing Form IL-1040 · Statement of Person Claiming 2017 Individual Income Tax Forms ; and Other Forms ; PDF · Filing · Payroll Tax ; Form IL-1050 ; Fax to State of Illinois.

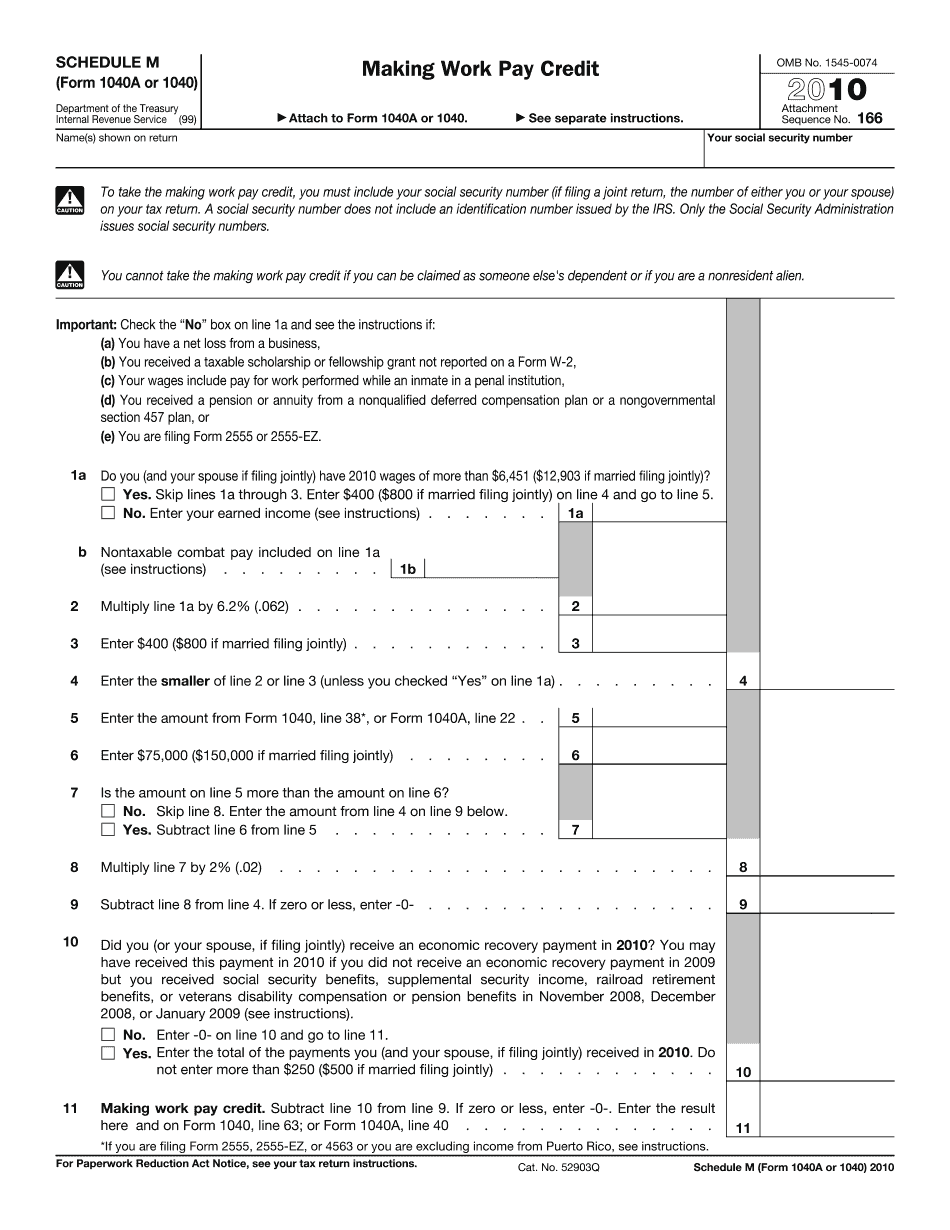

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040 - Schedule M, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040 - Schedule M online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040 - Schedule M by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040 - Schedule M from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 il 1040 instructions