Music, welcome to the Illinois Department of Revenue form IL 941 Illinois withholding income tax return video series. In this video, we will cover the 2017 withholding income tax changes detailed in informational bulletin FY 2017 - 7. This includes the elimination of the annual filing frequency and annual payment schedule. We will briefly discuss the secure choice savings program compliance question. We will also cover the payroll data and p10 requirements. Please note that these changes went into effect on January 1st, 2017. Several changes have been made to Illinois withholding income tax for the 2017 tax year. Effective January 1st, 2017, all Illinois withholding income tax filers are required to file their Form IL 941 returns quarterly. The annual filing frequency is no longer available. Your Form IL 941 is due by the last day of the month that follows the end of the quarter. For each quarter, you must include all Illinois income tax withheld during the corresponding three months. Please note, if the due date falls on a holiday or weekend, the return is due on the next business day. In addition to the annual filing frequency eliminations, the annual payment schedule is also no longer available. If you are currently an annual payer, the Illinois Department of Revenue has notified you by letter of your assignment to either a semi-weekly or monthly payment schedule for 2017. If you are a monthly payer and withhold over $12,000 in a quarter, you will be required to submit your payments electronically on a semi-weekly basis beginning the following quarter. For more information, see publication 131 withholding income tax payment and filing requirements. The publication can be found at tax.illinois.gov. A hyperlink to publication 131 can be found in the video description below. Your payment due dates are determined by the payment...

Award-winning PDF software

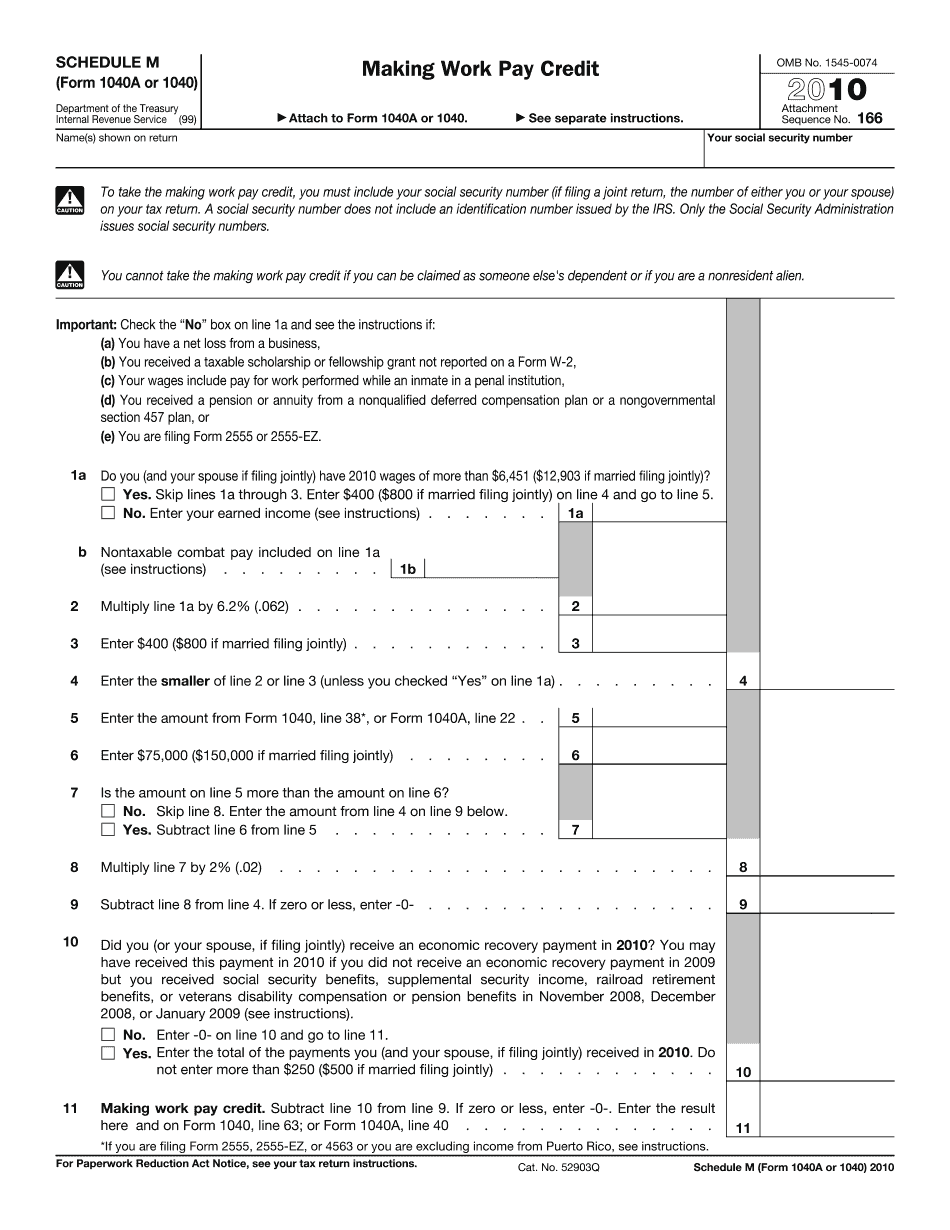

Illinois income tax instructions schedule m Form: What You Should Know

Your child's federally tax-exempt interest and dividend income as reported on U.S.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040 - Schedule M, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040 - Schedule M online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040 - Schedule M by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040 - Schedule M from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Illinois income tax instructions schedule m