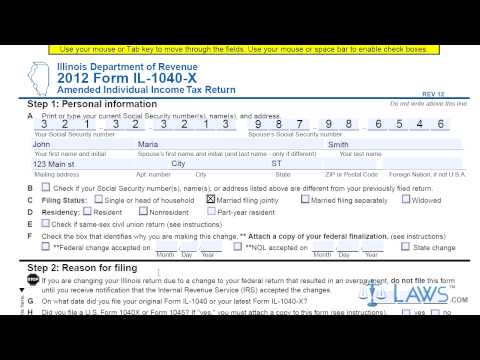

Laws.com provides a legal forms guide, including the form IL-1040-EX, for individuals in Illinois who need to file an amended individual income tax return. - To access this form, you can visit the website of the Illinois Department of Revenue. - Step one requires you to provide your name, mailing address, and social security number. If filing jointly with a spouse, both names and social security numbers should be provided. - If your social security number has changed since your previous return, indicate that on the form. - Indicate your filing and residency status using check marks. Also, indicate if you are a member of a same-sex civil union. - In step two, explain in detail the reason for filing an amended return. Include the date of your original IL-1040 form filing and whether you filed an amended federal return (if so, attach a copy). - Steps 3 and 4 have columns A and B. Column A requires you to enter your originally reported or last reported figures, while column B requires the corrected figures. Document your income in lines one through four. - Calculate your base income as directed in lines five through nine. - Note all exemptions being claimed in lines 10a through 10c. - Residents should calculate their net income in line 11, while non-residents should calculate their net income on line 12. - Calculate your tax due in lines 13 through 15. - Lines 17 through 21 concern non-refundable credits. - Adjust your tax liability based on household employment tax (if applicable) in lines 22 and 23. - Lines 24 through 31 deal with over payments previously made and credits. - Step 11 involves instructions on calculating the final balance or refund due. - To learn more, visit laws.com for additional videos. (Note: This text has been divided into sentences and corrected for some mistakes in grammar and punctuation.

Award-winning PDF software

Il 1040 es 2025 Form: What You Should Know

The amount of any other income, state tax refund, or refund-of-undefined-income reported on 2023 Form I-20, Statement of Financial Affairs 2023 IL-2031 Additions to and Part-year and full-year residents — Schedule R is amended to add the amount of. 2025 Form I-20, Sheet 2 2023 IL-2032 Subtractions from Schedule R — Form RNR is amended to add the amount of. 2025 Statement of Financial Affairs 2023 IL-2033 Schedule R is amended to add the amount of the income tax refunds of 0 or less claimed on Form RNR that you earned while a resident of 2023 Form I-20, Statement of Financial Affairs 2023 IL-2034 Schedule R is amended to add the amount of any income tax refunds of more than 0 or less claimed on Form RNR. This amount is added to line 19 of Form IL-2032. 2023 IL-2035 Additions to and Part-year and full-year residents — Add all deductions that are on Schedule R and then add line 4 of Form RNR, 2023 Statement of Financial Affairs and Line 4 of Form RNR, Line 4 of Form IR-2038 2023 IL-2036 Subtractions from Schedule R — Fill out Form RNR and attach lines 5-7 on Form IL-2037 and Line 1 of Form IR-2038. 2023 IL-2040 Additions to and Part-year and full-year residents — Enter the total of all income you received for yourself and for each spouse, 2023 IL-2041 Line 1, line 10, and Line 11. 2023 IL-2042 You may use Wins for Schedules M, Other 2023 IL-2043 Additions to and Part-year and full-year residents — Enter the amount of. 2025 Statement of Financial Affairs and Line 3 of Form IL-2037 2023 IL-2044 Section 831 deductions: Enter the amount of your section 831 deduction, or the amount you choose to claim, reported 2023 IL-2045 Line 7.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040 - Schedule M, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040 - Schedule M online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040 - Schedule M by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040 - Schedule M from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Il 1040 es 2025