Award-winning PDF software

5471 schedule j Form: What You Should Know

Demystifying the 2025 Schedule J How to Prepare an After-Deductible Election for Form 5471 Under the “Election” line on the Form 5471, you must choose to make an after-deductible election to report income on the Form 5471 for the tax years immediately preceding the taxable year in which you file your federal income tax return. The election allows the following to be reported on Form 5471: · Any dividends on a non-U.S. company shares paid to U.S. shareholders (the first line) · Other payments (the second line) · Income taxes paid on the payment, including income taxes paid to a U.S. government agency · Payments of interest (the third line) · Other amounts that would have been taxed in a U.S. jurisdiction had the payment not been made outside the U.S. To make an election, make sure the correct form is filled in on a separate sheet of paper. Form 5471 and What the Tax Law Says on the Record When it comes to determining what to report on your Form 5471, you have many choices. While all the usual requirements apply, the following are some things to look at when deciding what you should report. · Earnings All E&P of the foreign corporation (including dividends) are reported on the Form 5471. To show E&P, you may use an attached Schedule B To calculate E&P, you can subtract the cash flow from the E&P. You can also report income or loss on Form 1040. To take the E&P off Line 22, you may use Form 8832 (see Form 8832 for additional instructions). · Taxes If your foreign corporation files a tax return to the U.S., the amount of tax you claim generally will not change by having an election. However, for U.S. taxpayers, when an election is made to report earnings or profits in foreign currency and the U.S. corporation does not take foreign currency back (for example, because the corporation is incorporated in a foreign tax jurisdiction such as Canada or France, or it is a partnership or S corporation with a foreign member where the U.S. member does not take foreign currency back), then you may be required to file a Form 1040NR and Form 1040NR-EZ, as discussed in the article IRS Publication 523, U.S.

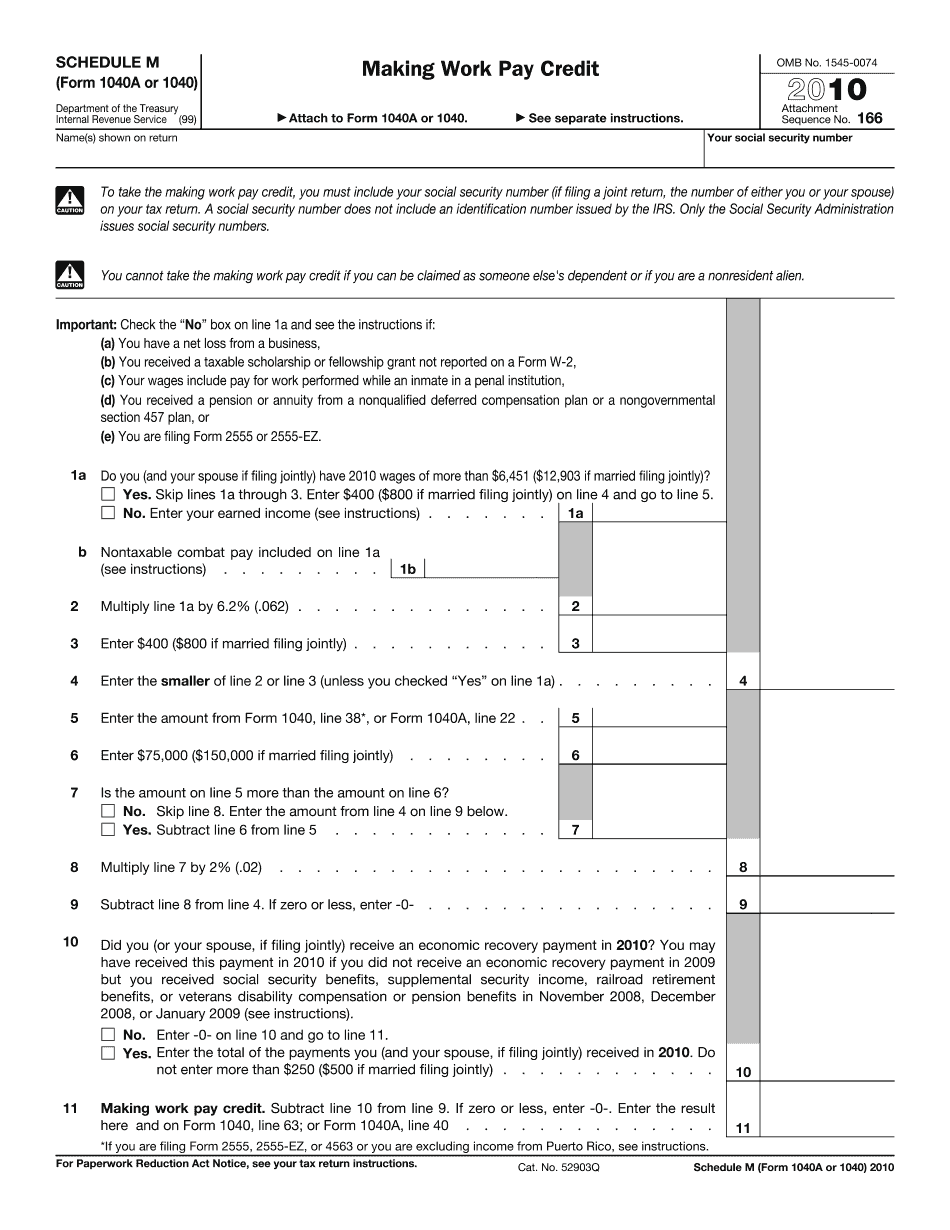

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040 - Schedule M, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040 - Schedule M online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040 - Schedule M by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040 - Schedule M from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.