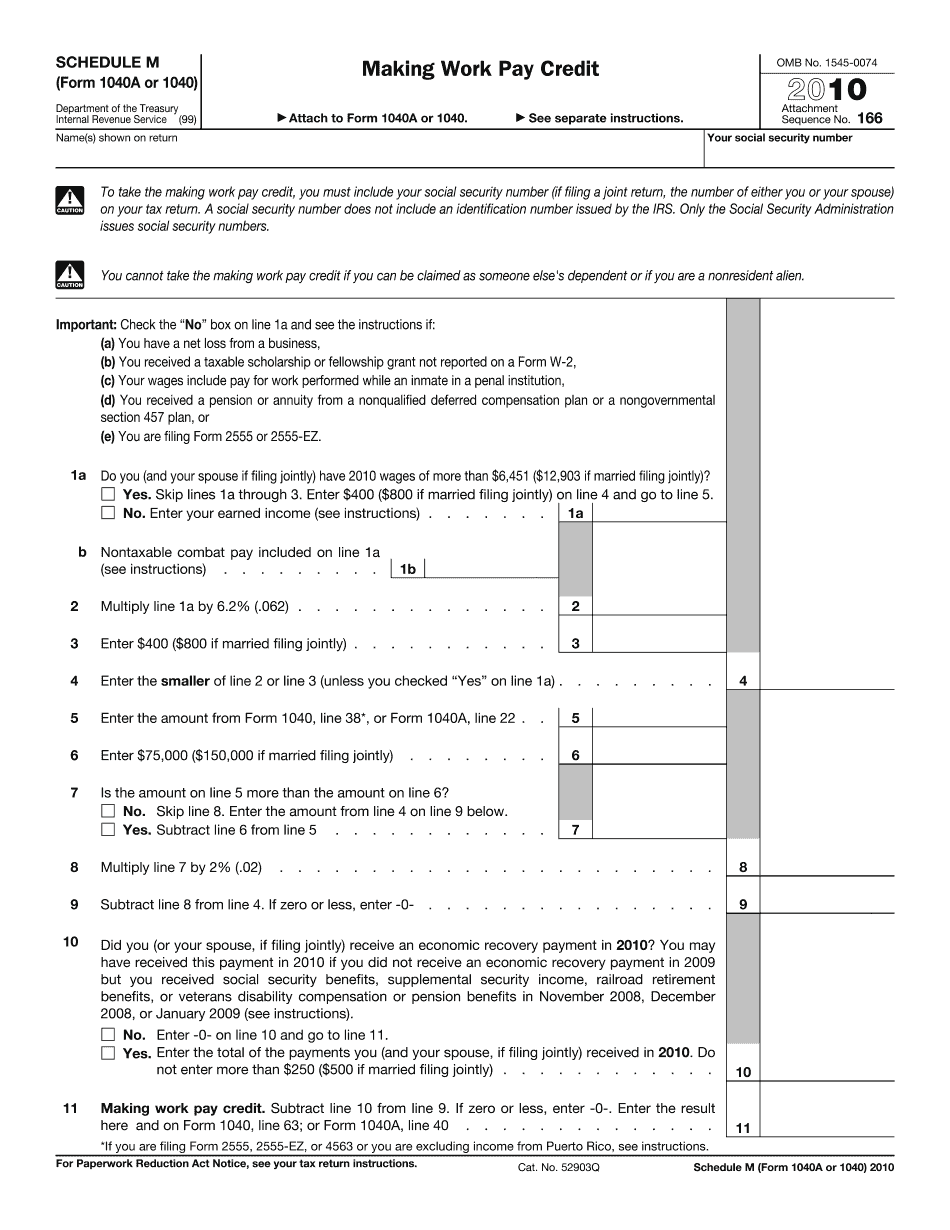

Form 1040 - Schedule M and Form 1040: Basics

Tax Schedule

The calculation is similar to the calculation of any calculation with taxable earnings. The tax return filed by a U.S. taxpayer is the return the IRS received on his or her return. The tax returned on a foreign return will not match up with a U.S. return. Tax Calculation The tax bracket rate is the tax rate that must be included in the total of income taxes to be eligible for the refundable credit. The tax break is the tax advantage that can be used to claim the refundable tax credit. This credit helps lower the amount of net income that must be reported for a U.S. taxpayers to qualify for a refund of the tax imposed. The total tax calculation includes the federal, state, and local income taxes, Social Security, Medicare, Medicare and other employee paid Medicare taxes, federal unemployment (FTA) withholding, federal and California state taxes, federal vehicle registration taxes, federal estate and gift taxes, federal excise taxes, California vehicle registration fees, and the estimated health insurance premium tax liability. The federal credit is calculated by adding back the taxes, any allowable creditable and excess employer-paid Social Security, Medicare, Medicare and other employee paid Medicare taxes earned prior to the filing of the return and any taxes withheld by the employer. The state credit is calculated by adding back the state payroll taxes paid by the employee and the employer. The employer's tax liability is the state income tax paid on the employee's wages. If other taxes are withheld from the employee's wages (such as taxes on social security and unemployment insurance as well as federal taxes), these taxes are not included in the calculation of the refundable tax credit. The federal, state, local, FTA, and income taxes paid by the employee are used to calculate the amount of tax owed by the employee to be reported. The Federal Insurance Contributions Act (FICA) tax and tax on employer-paid retirement plan contributions are not included in the estimate for a federal credit. In the case an American citizen lives abroad as a self-employed person while employed by a U.S. company, the taxes would be reported on her U.S. tax return. The employee would use Schedule F for FICA and Schedule C for employer-paid retirement income tax to report his

Form 1040: U.S. Individual Tax Return Definition, Types, and Use

A “tax return,” then, must be submitted to the IRS by an individual filing taxes for the year. This form is sent to the IRS by a taxpayer during the taxpayer's monthly tax response period, which is the time from the due date of filing the return to the payment of all the taxes due. The IRS uses its own rules when it determines which taxpayers fall within the monthly tax response period. Forms for Forms 1040 (Tax Returns) and 1040NR Use Form 1040, which can be mailed to the IRS or mailed to the address on the form. Form 1040 (Tax Returns) or Form 1040NR (NR1040NR) Form 1040, or Form 1040NR, can be sent to a tax processing facility in one of the following ways: The taxpayer can mail both forms directly to the IRS. Mail the form with an itemized statement of income and expenses to the address on the form. (See U.S. Filing Tips at page 7 for information on mailing the form in person.) Mail the form with an itemization statement of income and expenses to the address on the form. The taxpayer also can mail the form electronically to the address on the form using the IRS' Secure Access for E-File Users (SAFE) service. . The IRS can mail both forms directly to the taxpayer. Mail the form with an itemized statement of income and expenses to the address on the form. The taxpayer also can mail the form electronically to the address on the form within 3 or 45 days of the taxpayer's filing due date. To help taxpayers with complicated transactions, or who have questions about mailers for electronic filing, ask them about the Electronic Data Retrieval Service (EARS) (Form W-6). Forms for Forms 1120, 1040A and 1040NR Use Form 1120, which can be mailed to the IRS or mailed to the address on the form. Form 1120 (Tax Forms) In some cases, taxpayers may still want to complete one form for both the 1040 and the 1120 form that the taxpayers filed using a different address on the 1040. Form 1120 should not be used only if the taxpayer did not use a different address on the 1040 and the 1120 forms. When filing the 1040 and 1120 together, send both forms as a single PDF, not one single

Award-winning PDF software