Award-winning PDF software

Form 1040 - Schedule M for Brownsville Texas: What You Should Know

Per Diem Pay and Per Diem Rates — GSA The rules and requirements for obtaining an increase in per diem rates differ from state to state. You'll need to check with local city or county agencies to know the exact requirements for each county. For example, many states require an employment statement or similar documents to gain a per diem rate increase. The IRS doesn't require any form. Your city or county or state agency of local government will likely determine what information is needed. The IRS will have more information about their rate changes (Per Diem, Pay, and Per Diem Rates). Filing Information for Form W-2G, Wage and Tax Statement — IRS Per Diem Pay Rates — GSA When a federal law that changed in 2025 required all employers to give the employees more frequent per diem pay increases, some states responded by adopting countywide per diem rates. In other states, including Texas, local rate pay and per diem rates are still based on federal law. These laws have been updated in some cases. Please contact your local city or county office of taxation to see if you're eligible for the countywide rate and the applicable federal rate. A countywide per diem rate is 24.78 per day if you work 7 days in a calendar month on a full-time basis. If you're eligible for a countywide rate, and you work at least 26.5 hours per week, you can reduce your local rate by 1/24 of one percent. In other words, your per diem rate will be 8.58 (26.5/64). Additional Income Information Form W-2G, Wage and Tax Statement — IRS Per Diem and Pay Rates — GSA A countywide per diem rate of 15% will be increased to 16.15% effective January 1, 2008. Additional Tips for Texas Per Diem and Tax Payments Federal law requires that if you receive a per diem payment of more than 25 per day, your state must pay you at least 0.25 for you to receive 25 per day. To receive federal payments of more than 25 per day, you must pay the federal tax from the state income and employment taxes paid to the Texas Department of Public Safety in an amount sufficient to cover the federal tax for the first day of the payment period.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1040 - Schedule M for Brownsville Texas, keep away from glitches and furnish it inside a timely method:

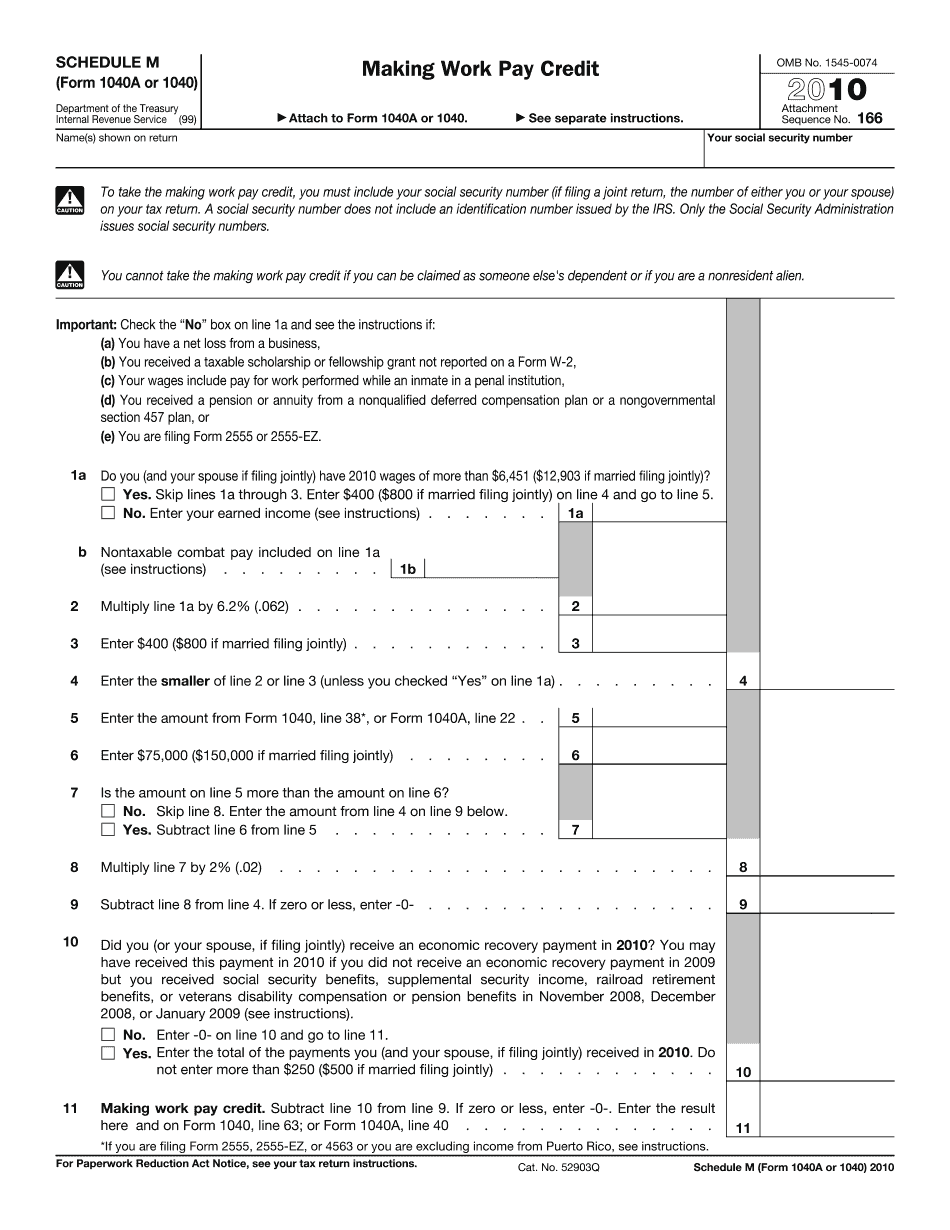

How to complete a Form 1040 - Schedule M for Brownsville Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1040 - Schedule M for Brownsville Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1040 - Schedule M for Brownsville Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.