Award-winning PDF software

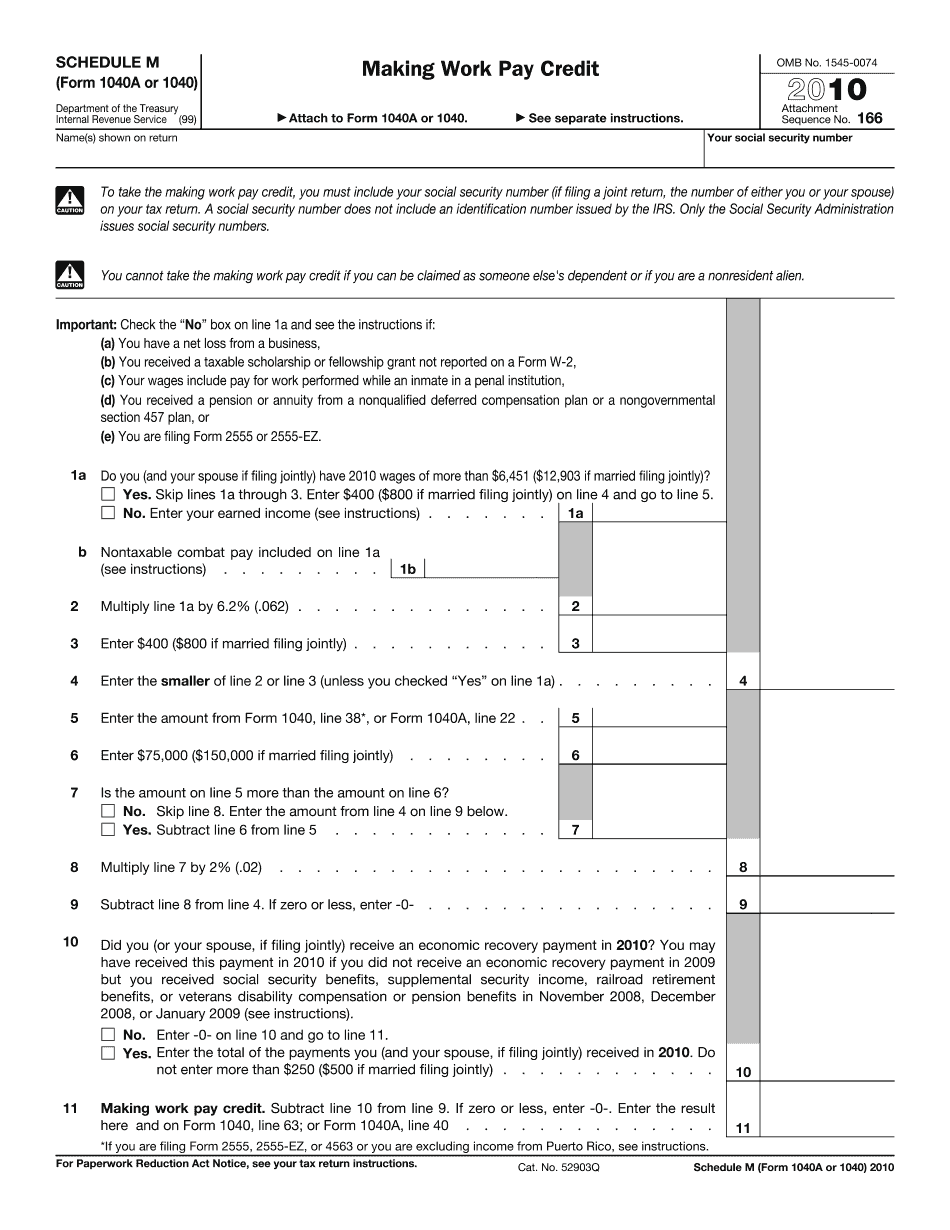

Form 1040 - Schedule M online Grand Prairie Texas: What You Should Know

The Grand Prairie IRS Field Office contacted Williams, alleging Williams knowingly failed to declare to the IRS that he had an unlisted bank account. However, the United States District Court in Travis County, Texas Circuit of Texas, where the case is pending, has also previously dismissed all evidence presented by the IRS. After the federal judge in this matter dismissed all evidence, Williams' counsel has filed this motion asking the Court to appoint a Special Master to take over this case for the cost of litigation. Williams' petition is in relation to a non-pecuniary matter. The Special Master is appointed and discharged in accordance with 28 U.S.C. § 676(a)(5). Tax Law & Consulting in Grand Prairie, Texas and Dallas, TX In-Depth Interview of Grand Prairie, Texas, CPA and CPA-Tax Service — Dallas, TX CPA & Tax Service The best tax services in Dallas, TX — Yelp Best Tax Services in Dallas, TX — Tax Service Texas Litigation Strategy & Legal Consulting in Grand Prairie, TX — Litigation Strategies, LLC Jan 11, 2025 — As an individual, you may apply for a refund filing after a refundable tax credit (RTC) for 2025 was determined to be an invalid claim. But, this doesn't apply to an individual who has a prior year tax liability for 2009, and you have to file Form 2106, Income Tax Return with the amended tax year information. The amended return is filed for the prior year taxes, including penalties, interest, net proceeds from the sale of a gain, and additional tax. There are two ways to file an amended return, depending upon the amount of tax owed and the filing period for the claim. The Form 2106 and the Form 2106-A can be filed on a calendar year basis if the tax you are claiming is less than 25,000 and less than 50,000. Or, Form 2106 and Form 2106-A can be filed on either a calendar or a fiscal year basis, if the tax you are claiming is between 25,000 and 50,000. The best tax service in Grand Prairie, TX — Yelp DUE DATES Form 1040 — 2017-02 for filing, and Form 1040 – 2025 and 2017-02 for filing a claim to refund or credit for 2025 taxes.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1040 - Schedule M online Grand Prairie Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1040 - Schedule M online Grand Prairie Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1040 - Schedule M online Grand Prairie Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1040 - Schedule M online Grand Prairie Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.