Award-winning PDF software

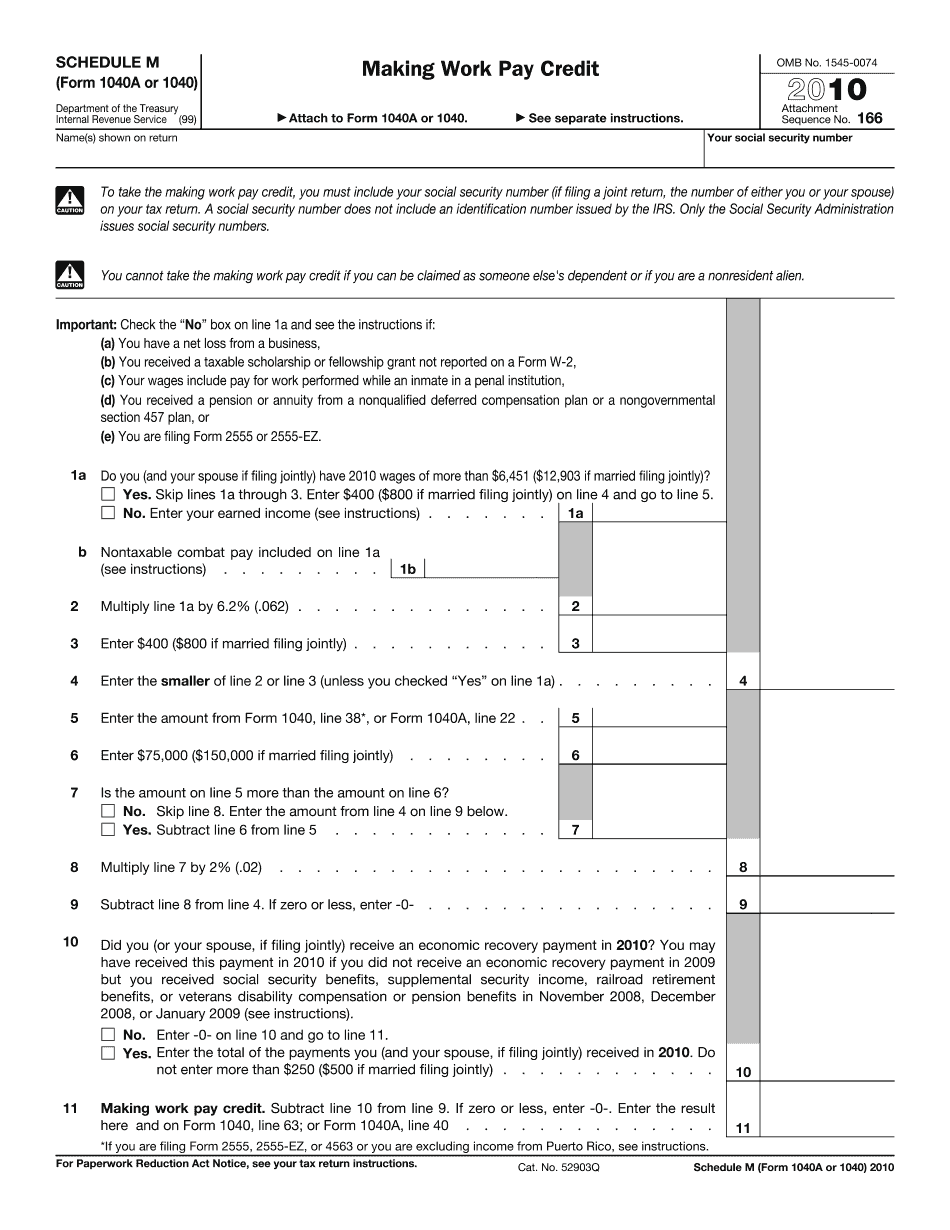

Form 1040 - Schedule M online Tucson Arizona: What You Should Know

Notation is also required. Also includes the cost or value of any tangible personal property including, but not limited to items shipped or transported from another state or country to or from this state. Tax-Free Shopping Spree — City of Phoenix Inspectable retail sales tax on apparel. Free sales tax exemption for sales to individuals and charities. Free sales tax exemption for sales with a qualifying charitable gift. Tentative Dates for 2025 Tax Return Filing Season Tentative dates for filing individual income tax returns beginning on July 22, 2019. Arizona will begin the 2025 tax filing season for individual tax returns the week of September 11, 2018. The filing season is expected to run through mid-November 2018. Tentative dates for filing combined state and local income tax returns beginning July 22, 2019. Arizona will begin 2025 tax filing season for combined state and local return the week of October 12, 2018. The filing season is expected to run through mid-December 2018. Tentative dates for filing sales/use tax returns beginning July 22, 2019. Arizona will begin the 2025 tax filing season for sales/use tax returns the week of October 27, 2018. The filing season is expected to run through mid-January 2019. Tentative dates for filing federal tax returns beginning on July 22, 2020. Arizona will begin the 2025 tax filing season for federal returns the week of November 15, 2018. The filing season is expected to run through mid-March 2019 For questions concerning the Arizona State Tax Collection Agency or your rights as a consumer contact The Arizona Department of Revenue at or call toll-free from all of America's mobile phones and landlines at (TTY toll-free). The office is open Monday to Friday, 8 a.m. to 5 p.m. The Taxpayer Advocate Service provides information and assistance to consumers. To locate a Taxpayer Advocate in your community, call (TTY toll-free ) or visit the Taxpayer Advocate Program's website at . Tax and Other Information for Individuals, Partnerships, Associations, and Estates A.A.N.A.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1040 - Schedule M online Tucson Arizona, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1040 - Schedule M online Tucson Arizona?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1040 - Schedule M online Tucson Arizona aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1040 - Schedule M online Tucson Arizona from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.